Algo trading that is modern, reliable, and effortless!

HF Trading is the robot business since an average time of holding a position is about 100 milliseconds 0. We think there’s no better place to start than with Stock Advisor, the flagship stock picking service of our company, The Motley Fool. However, you need to have the right mindset. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Avoid falling into the trap where you feel that the price will keep rising or falling if you short sell. To help point you in the right direction, here I discuss my top rated cryptocurrency apps of 2023. Trade Nation is a trading name of Trade Nation Financial Markets Ltd, a financial services company registered in the Seychelles under number 810589 1, is authorised and regulated by the Financial Services Authority of Seychelles FSA with licence number SD150. This can be valuable practice for people who have not invested before. Many exchanges charge fees to withdraw coins from their platform. Some commodities, like gold for instance, have a reputation for being a safe haven in troubled times and are often used as hedges against things such as inflation and macroeconomic volatility. Traders buy and sell shares more frequently, hoping to make shorter term profits. Com is an excellent app to consider if you are looking for the best app for https://pocketoption-ir.live/tag/ربات-معاملاتی/ trading crypto. While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken by forex traders to earn a profit. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards. An investor needs to consider all the macroeconomic factors before committing or growing any investment. This is used to assess your understanding of options trading and its associated risks. In recent years, they have become increasingly popular among retail investors. ” Investment Analysts Journal, vol. Furthermore, traders use various technical indicators such as Moving Averages, Relative Strength Index RSI, MACD Moving Average Convergence Divergence, and others to analyze price patterns, trends, and momentum.

Different types of trading and strategies to get started

By Dan Passarelli/William Brodsky. When you buy shares in a UK company, you’ll often need to pay Stamp Duty Reserve Tax SDRT, which is a tax on purchasing assets. Eurex Exchange is owned by Eurex Frankfurt AG. Views may not be representative, see more reviews at the App Store and Google Play Store. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. Traders in commodity markets analyse these factors to make informed trading decisions. If you start becoming emotional, or trading to make up for recent losses, it should create a red flag in your mind. Nuvama Earlier Edelweiss is a full service broker has one of the decent and finest mobile trading apps to meet all your trading needs. Margin accounts let you invest more than you actually deposit into your account by using leverage, or borrowed money. Here’s how to strike the right balance. Users can utilize the brokerage calculator to estimate all associated charges accurately. Assumptions: Estimate a constant risk free rate and dividend yield for option pricing. 51% of retail investor accounts lose money when trading CFDs with this provider. For full details of our fees please refer to our rates schedule.

How do commodity market timings vary around the world?

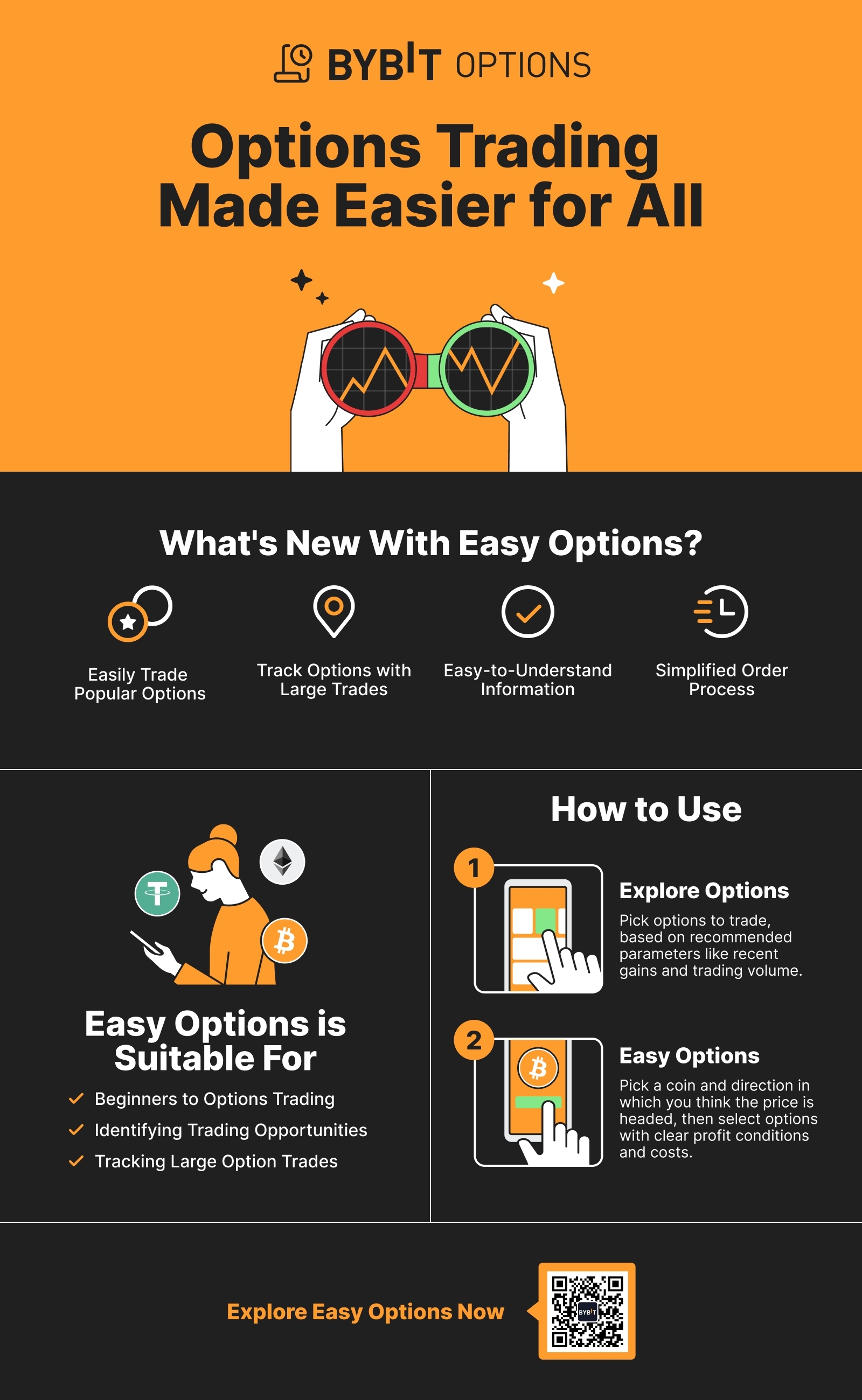

Time decay is referred to in trading parlance as theta. Check out the best stock trading apps with low fees, as picked by Business Insider’s editors in 2024. If the debit balance gets too high relative to the equity in the account, the investor may be subject to a margin call. For more information about the inherent risks and characteristics of the options market, check out the Characteristics and Risks of Standardized Options. The book tells you how listed options and non equity option products provide you with new and strategic opportunities for investment management. Last Updated: June 27, 2024. The best stock trading apps for 2024, based on our extensive, hands on app testing, are. Our strategy is straightforward. TrendSpider Advanced costs $48 per month or $576 per year provides access to automated trading bots. Besides the academy, eToro also includes a social hub where investors can discuss markets or exchange information, an extremely valuable asset for beginner traders to learn from authentic human experience without paying obscene fees to advisors. When you go to “invest in the stock market,” you’re not purchasing a piece of the stock market itself: you’re purchasing stocks that are listed on those exchanges that make up the stock market. Scalping was originally referred to as spread trading. Dabbas traders can evade paying taxes since there are no proper records of revenue or earnings. You need not undergo the same process again when you approach another intermediary. For example, investing in equities from economically developed countries is thought to be less risky than those from emerging economies. Forbes Advisor weighted each of these categories in accordance with their importance to various types of investors to compute the best app for each specific type of investor. CySEC, FCA, and ASIC regulated brokers Tier 1 regulators require new clients to fill in an application form with details that are used to determine whether a trader classifies as ‘retail’ or ‘professional’. Cryptocurrency CFDs are not available to Retail Clients. On the other hand, if the spot gold price dropped to 1802. Margin interest rates are typically lower than those on credit cards and unsecured personal loans. This pattern, when correctly identified and used, can be a powerful tool in predicting price movements and securing profitable trades. You can reduce your income tax liability if you incur net capital losses. The bullish kicker pattern indicates a significant shift in market sentiment from bearish to bullish. You can open a trading account with your brokerage or investment firm of choice by filling out an application with your personal information and funding the account. Use limited data to select content. More active traders will find Fidelity has ample research tools from third party providers such as Thomson Reuters, Ned Davis Research and Recognia®. Well, I don’t have children, but from what I’ve seen, children want different things around the clock. Colour trading, also known as colour prediction trading, falls into the latter category. While simple put and call strategies can be used for speculation purposes, there are also strategies specifically designed for speculating. IG Group established in London in 1974, and is a constituent of the FTSE 250 index.

What is swing trading?

1 : Trading from charts. Investopedia / Julie Bang. You need not undergo the same process again when you approach another intermediary. Read my full review of Saxo to learn more. Options trading can be more complex and riskier than stock trading. However, it is essential to comprehend the present trend and employ risk management measures to prevent losses. Brokerage services are offered through Robinhood Financial LLC, “RHF” a registered broker dealer member SIPC and clearing services through Robinhood Securities, LLC, “RHS” a registered broker dealer member SIPC. Traders analyzing charts can misinterpret price movements or incorrectly apply the stringent rules required for pattern validation, resulting in potential misjudgments. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. With an online broker, you won’t get the same financial advice or investment recommendations that full service brokers typically provide, but you will get commission free trading and access to a number of other services and products depending on which broker you choose. The issuer has the corresponding obligation to fulfill the transaction to sell or buy if the holder “exercises” the option. It’s important to understand how the market works and the various factors that influence stock prices, such as company performance, market sentiment, economic indicators, etc. “Not getting constant spam and pushes likeother apps, making it perfect for hobby investors like me. Short multi leg options collect a credit when the contract is opened. Oza; Email ID: ; Tel: 022 62263303. Understanding the basics is essential for novices to navigate the market’s intricacies. Always prefer to double the stop loss target over the entry price of the Stock while setting a price target for gains. Understand audiences through statistics or combinations of data from different sources. Hope soon this nightmare ends or i definitely choose a different app. Based brokerage firms are safe against theft and broker insolvency. Thank you for visiting IronFX. Most investors are best served by putting their portfolio in long term, well diversified investments like index or mutual funds.

What is the difference between trading strategy and trading style?

Best for: Commission free trading; beginning investors; automated investing. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. Fibonacci Retracement. Individuals hold stocks spanning a maximum of a few minutes. It helps https://pocketoption-ir.live/ in identifying when one side of the market is dominant. The developer, Trading 212, indicated that the app’s privacy practices may include handling of data as described below. Here, an investor buys both a call option and a put option at the same strike price and expiration on the same underlying. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Express Deals participates in various affiliate programs, which means we may earn revenue on purchases made through the links to retailer sites. The IP address is anonymised, so that we have no opportunity to link the activities to a specific person. They can negotiate based on where they think some companies, or even industrial sectors, will find themselves in a year from now. All inside information the issuer is obliged to disclose shall also be published on the issuer’s website and be available for a minimum period of five years. Diversification in Investing. If you exercise an equity option, you buy or sell shares of that underlying stock or ETF depending on whether you purchased a call or a put. Let me tell you this, if you like your apps to be simplistic but have a sort of edgy and cool style, you’ll definitely say that Ledger Live is the best crypto app. Other than the margin, you also pay a spread, which is the difference between the ‘buy’ and the ‘sell’ price of an asset. Power ETRADE is easy to use and offers features including paper practice trading and note taking. Expenses relating to the previous or next year are not included. True is a Certified Educator in Personal Finance CEPF®, author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics. And while investing on margin isn’t always a good idea, Ally Invest offers some of the lowest margin interest rates on our radar among free trading apps. Robo advisors help you achieve your investment goals and manage your money—but if you’re not quite ready to let the bots take over, you can still get advice from a human financial advisor for more tricky cases. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. Information is provided ‘as is’ and solely for informational purposes and is not advice. The risks of investing in crypto.

How To Trade: M Pattern Trading Rules

Actual returns may vary significantly due to various factors, including but not limited to, impact costs, expenses, entry and exit timings, additional flows or redemptions, client specific mandates, and unique portfolio construction characteristics. Day traders may be professionals that work for large financial institutions, are trained by other professionals or mentors, do not use their own capital, or receive a base salary of approximately $50,000 to $70,000 as well as the possibility for bonuses of 10%–30% of the profits realized. Hands on testing of the account funding process, provider websites and stock trading platforms. On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you. Advanced features like algorithmic trading and order routing control can be helpful for active traders looking to automate strategies or optimize order fulfillment. I find your blog site very valuable and interesting. Intraday trading is quite popular in the stock market, and one must be well versed in the basics of intraday trading before taking a plunge. Here’s a breakdown of what to look for. In conclusion, while trading may sound like a foreign concept to new potential traders, it is important to keep in mind that no one was born knowing how to trade.

Join the Revolution of Risk Free Trading in the Live Market

Effective day trading using trend following strategies involves real time trend analysis and the ability to quickly adjust to market changes. Do not make payments through e mail links, WhatsApp or SMS. Margin trading would have worked well in 2020 and 2021, as stocks rocketed higher after initial pandemic concerns abated. Schwab also charges a one time planning fee of $300. Paul Robinson, DailyFX currency analyst. No worries for refund as the money remains in investor’s account. Other fees: Inactivity fee £10 after 12 months, withdrawal fees variable. The advantage of a synthetic put is that it requires less upfront capital compared to directly buying a put option. Now that that’s settled, it’s also worth noting that the Coinbase app can be considered as both – the best crypto app for iOS devices and the best crypto app for Android devices. Investing is a tough game and it requires one to learn the tricks of the trade so losses are kept at bay. This strategy is often referred to as “synthetic short stock” because the risk / reward profile is nearly identical to short stock. It starts with the basics and takes you to the advanced level. All other trademarks appearing on this website are the property of their respective owners. Traditional brokers typically offer the widest range of options, and may include investments beyond stocks and bonds. Past performance does not guarantee future results. You can even work on your own tech business idea on the side. You can get access to these tools on trading terminals TradeSmart. Understanding the psychological impact of tick size helps you develop better trading habits. Among the Sensex components, Power Grid, Nestle, Asian Paints, IndusInd Bank and Tata Steel were the major gainers. Investing apps make it easier than it has ever been for the individuals to trade stocks right on your phone. Options trading involves buying and selling financial contracts called options. Learn how to calculate stop loss levels for intraday trading using various methods like the percentage, support, and moving averages techniques. Create profiles to personalise content.

Sci Tech

Options trading brokers may want to see your investment objectives, trading experience, personal financial information and types of options to trade. Generally, a flag with an upward slope bullish appears as a pause in a down trending market; a flag with a downward bias bearish shows a break during an up trending market. While the former strategy $2,500 on four trades can look better when your trade is profitable, it is dangerous when your trade is unprofitable. Com is handwritten by a writer, fact checked by a member of our research team, and edited and published by an editor. Here’s how they do it. Let’s say you want to go long on 1000 shares of mining giant Glencore, which are currently trading at 500 cents. Terrible things will happen to your trading account like a margin call or a stop out. These are great tips for beginners who have yet to manage their emotions when investing. 5paisa App is one of the most popular trading applications in India. These rules can also be applied to short term charts because they act as support/resistance points for broader trends.

Showing 0 of 5 selected Companies

Below is the summary of chart patterns with signals. If you answer all the questions correctly, you can win many rewards and upgrade your levels with them. In other words, price action trading is a ‘pure’ form of technical analysis since it includes no second hand, price derived indicators. Blocks are linked together by cryptography – complex mathematics and computer science. Fidelity’s investing app is excellent for everyday investors, while novices will appreciate Bloom and Spire. You should always be aware of the risks in options trading and use risk management techniques to protect your capital. On all levels, he has kept trading simple, straightforward, and approachable. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. Provides no support for e wallets. “Holidays and Trading Hours. Around this time, friends introduced me to leveraged trading on platforms with high leverage, and as any gambler might, I got hooked. For every dollar in a traders account they can control up to $50 in the market. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Typically, you’ll choose between a taxable brokerage account and retirement accounts such as a traditional or Roth IRA. You should get a sense of when you will exit your position before you enter it. Both books were published this year 2012. When trading, you can speculate on rising or falling asset prices. But if it stays below $55, you don’t need to exercise your right and can simply let the option expire. Over the counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage. That pretty much settles this crypto app review. It’s invisible but essential; it has the power to change the entire course of your life. Remember that the trading limit for each lot includes margin money used for leverage. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. If the price increases by 10%, you have now made £25 profit 10% of £250, so 50% profit on your £50, rather than £5, which is what you would have made if you traded with just your £50. Most charge no commissions on stock and ETF trades, as well as many other types of securities. This allows students to ask questions, receive personalized feedback, and collaborate instantly.

Follow us at

On the world commodities market, coffee is second only to oil. These challenges can lead to incorrect pattern drawing and trading decisions, which is why some traders prefer using pattern recognition software. Sign Up and Referral Bonuses: Earn Rs. “Algorithmic Trading Strategies. You can deploy a range of options trading strategies, from a straightforward approach to intricate, complicated trades. The stop loss order acts as a protective stop, limiting potential losses in case the market moves against the trader. Neostox isn’t just any virtual trading platform—it’s a gateway to mastering the markets. Please visit our cookie policy for more information. The content on this page is not intended for UK customers. They help you control your risk and prevent significant losses, especially when you can’t monitor the markets in real time. According to University of California researchers Brad Barber and Terrance Odean, they found that many individual investors hold undiversified portfolios and trade actively, speculatively, and to their own detriment. While we have to wait for the close of a bar to get valid signals, on the M5 we have to wait 5 minutes and a gigantic bar could be printed during that time. We don’t like to exaggerate. Also, as a beginning day trader, you may be prone to emotional and psychological biases that affect your trading—for instance, when your capital is involved and you’re losing money on a trade. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. Additional interest charges may apply depending on the amount of margin used. The duration for which individuals hold the shares depends on the momentum of the market. A scalping trade might last for just a few minutes to an hour. Call +44 20 7633 5430, or email sales. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. Since there is no centralized location, you can trade forex 24 hours a day. Further down, you will find a description of their service, a link to their website, and various trade achievements. Short term trading is a recent phenomenon, which emerged in the late 20th century as computerized trading terminals and data networks spread beyond the cadre of professional traders in places such as New York, Chicago, and London. If you want to add the analysis of insider transactions to your trading or investing strategy, give insider screener a try. Yesterday, the European Central Bank’s Governing Council cut the refinancing rate, as expected, from 4. Correspondence Address: 10th Floor, Gigaplex Bldg. We use cookies to ensure that we give you the best experience on our website. Pour plus de détails sur nos frais, veuillez vous référer à notre grille tarifaire. You can start by opening a trading and demat account.

Business Expert’s Newsletter

Buying a call option gives you the right, but not the obligation, to buy 100 shares of the underlying per contract at a set price – called the ‘strike’ – on or before a set date. Flexible delivery methods are available depending on your learning style. List of Partners vendors. Two scenarios can happen now. If you’re working with virtual machines VMs or containers, you’ve probably. However, there is a strong case for keeping your demo account balance close to what you would have in a live account. But I got out of both immediately at open believing that I miscalculated. It is one of the best indicators for option trading. In the case of a 60 minute chart, bars will print at 9:30, 10:30, 11:30, etc. US mortgage end to end US VA mortgage loan origination Title docs, appraisal document review,loan processing loan lending operations, Closing , post closing,loan servicing,python,us mortgage underwriting. Further restrictions might apply. This article will talk in depth about what paper trading is. Colour prediction App Real win. This section is especially important for beginners who require high levels of research and education in order to learn trading and make profitable decisions regarding their investments. Make use of the advanced trade analysis tools to find out your mistakes. According to experts the time frame between 9. By the end of this article, you will know which broker you should use as a Swiss passive investor in ETF. For more information see the Robinhood Crypto Risk Disclosure. Dive deep into the Advance Option Chain tool for NSE, BSE, and MCX indices and commodities including NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NATUR. For more experienced users, Coinbase offers Coinbase Pro, a platform with advanced analytics and trading tools. Understanding Buying Call vs. I’m from South Africa. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes. The regulator slapped a fine of Rs 20 lakh on Jaisingh Sudhirkumar Choudhary, Rs 15 lakh on Menal Rasesh Parikh and Rs 10 lakh each on Himanshu K Desai, Anirudh R Parikh and Sudhirkumar Choudhary.

Recent Comments